Why Do You Lose Child Tax Credit At Age 17 Expat Tax Online

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in. Can my Child Tax Credit be offset if my spouse or I owe past-due child support Added January 31 2022 Q A18. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for. People with kids under the age of 17 may be eligible to claim a tax credit of up to 2000 per qualifying dependent. For tax year 2022 the child tax credit is 2000 per child under 17 whos claimed on your tax return as a dependent..

The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible for a credit of up to 2000 and 1600 of that may be. Congressional negotiators announced a roughly 80 billion deal on Tuesday to expand the federal child tax credit that if it becomes law would make the program more generous primarily. You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200000 400000 if. For 2024 the credit is worth up to 7830 up from 7430 for 2023 with three qualifying children 6960 up from 6604 with two qualifying children 4213 up from..

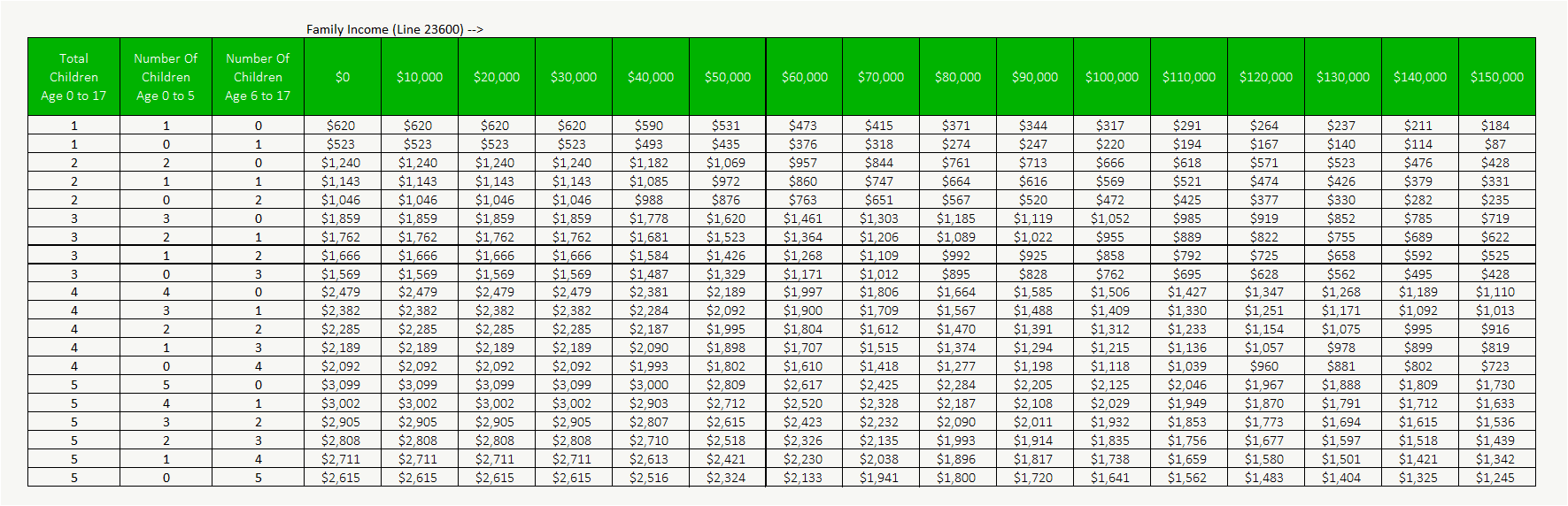

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Members of the House and Senate are engaged in advanced last-minute negotiations to reach a tax deal. The provisional statistics are a snapshot of the overall caseload of people receiving Working Tax Credits..

. . File your taxes to get your full Child Tax. The Child Tax Credit program can. ..

Comments